10-15-20 Rule: Calculate how much do you need to retire, quickly.

Can you quickly calculate how much money would you we need to retire without going thru detailed and elaborate calculations? Is there a thumb rule that gives a good approximate idea about this amount?

There are 2 studies done in the US in 1994 (William Bengen) & 1998 (Trinity Study) that concluded that one needs 25 times the annual expenses to retire. Assuming that your retirement kitty is invested in stock + bonds, one can withdraw 4% of this every year and this will most likely ensure that you won't run out of money for at least 33 years. Both these studies use historical US stock and bond data and hence may not be extended to other countries.

The question is, can one derive a thumb rule without using any historical data? Can one estimate this amount by looking at expected post-retirement lifespan, annual expenses and rate of earning on the retirement kitty?

Let’s assume that we have 3 kinds of people, categorized based on how they invest their retirement kitty. The first one is extremely conservative and invests money primarily in Bank FDs and Government Savings Schemes. The post-tax return for this investor is likely to be close to the rate of inflation.

Another category that invests a little bit in equity (say 20%). This portfolio is expected to generate a long-term, post-tax return that is 1% more than the rate of inflation.

The third category is a bit more aggressive and invests a higher percentage of the kitty in equity, resulting in total portfolio return that is 2% more than inflation. You can also add one more category that generates inflation + 3% return due to even more aggressive investment style.

The return one earns over inflation is more important than absolute rate of return. Inflation erodes the value of your wealth while your rate of return increases it.

10-15-20 Rule :

The 10-15-20 Rule that we have developed, will allow you to calculate retirement kitty for each of these categories assuming they would generate post-tax returns equal to inflation, 1% over inflation, 2% over inflation and 3% over inflation.

Let's say you have just retired at 60 and your annual expenses are 10 lacs (i.e. 1 million). If you expect to live up to 100 years then the amount you need is 10 lacs x 40 years of retirement = 4 crores (or 40 million). Let's say that the inflation rate is 5% and you are also able to generate 5% post-tax return on your retirement kitty. In this case, the effect of inflation will be completely offset by the post-tax return.

This means that every year you will be able to drawdown 10 lacs from your invested retirement kitty, adjusted for inflation. Every year the amount you can withdraw will go up by 5%, compared to the previous year. For the first year it will be 10 lacs, the second year it will go to 10.5 lacs and so on. This 4 crores will last for 40 years if your post-tax return marches along with the rate of inflation. The 10 lacs expenses today will grow and become 67 lacs towards the end, due to inflation. You will be able to meet these higher expenses as the balance amount in the portfolio too would be growing at the same rate.

There are 2 studies done in the US in 1994 (William Bengen) & 1998 (Trinity Study) that concluded that one needs 25 times the annual expenses to retire. Assuming that your retirement kitty is invested in stock + bonds, one can withdraw 4% of this every year and this will most likely ensure that you won't run out of money for at least 33 years. Both these studies use historical US stock and bond data and hence may not be extended to other countries.

The question is, can one derive a thumb rule without using any historical data? Can one estimate this amount by looking at expected post-retirement lifespan, annual expenses and rate of earning on the retirement kitty?

Let’s assume that we have 3 kinds of people, categorized based on how they invest their retirement kitty. The first one is extremely conservative and invests money primarily in Bank FDs and Government Savings Schemes. The post-tax return for this investor is likely to be close to the rate of inflation.

Another category that invests a little bit in equity (say 20%). This portfolio is expected to generate a long-term, post-tax return that is 1% more than the rate of inflation.

The third category is a bit more aggressive and invests a higher percentage of the kitty in equity, resulting in total portfolio return that is 2% more than inflation. You can also add one more category that generates inflation + 3% return due to even more aggressive investment style.

The return one earns over inflation is more important than absolute rate of return. Inflation erodes the value of your wealth while your rate of return increases it.

10-15-20 Rule :

The 10-15-20 Rule that we have developed, will allow you to calculate retirement kitty for each of these categories assuming they would generate post-tax returns equal to inflation, 1% over inflation, 2% over inflation and 3% over inflation.

Let's say you have just retired at 60 and your annual expenses are 10 lacs (i.e. 1 million). If you expect to live up to 100 years then the amount you need is 10 lacs x 40 years of retirement = 4 crores (or 40 million). Let's say that the inflation rate is 5% and you are also able to generate 5% post-tax return on your retirement kitty. In this case, the effect of inflation will be completely offset by the post-tax return.

This means that every year you will be able to drawdown 10 lacs from your invested retirement kitty, adjusted for inflation. Every year the amount you can withdraw will go up by 5%, compared to the previous year. For the first year it will be 10 lacs, the second year it will go to 10.5 lacs and so on. This 4 crores will last for 40 years if your post-tax return marches along with the rate of inflation. The 10 lacs expenses today will grow and become 67 lacs towards the end, due to inflation. You will be able to meet these higher expenses as the balance amount in the portfolio too would be growing at the same rate.

Thus 4 crore is the amount required to retire for the 1st category of investor.

For the second category of investors, who can earn a return of 1% over inflation, the amount required will be lower, as their portfolio balance will grow at a slightly faster rate than the inflation. The retirement amount required will be equal 3.33 crore for meeting inflation-adjusted expenses of 10 lacs per annum. This is calculated by dividing 4 crores (calculated for the first investor) by 1.20 .

For the 3rd category, that earns 2% over inflation - the amount will be 4 Cr divided by 1.40 , equal to 2.85 Cr and for the 4th category (return of 3% over inflation) it would be 4 Crores divided by 1.60 = 2.5 Cr

We are dividing the 4 crore by 1.20 when the rate is 1 % over inflation , which can be seen as 1+ 20 x 1% = 1 + 20 x 0.01 = 1.20

Thus when you have 40 years to go, one can divide 4 core by 1+ 20 x % return over inflation to work out the reduced amount required for retirement.

The rule works for 30 years lifespan and 20-year lifespan too, provided you replace 20 in the above formula by 15 and 10 respectively. This is the 10-15-20 Rule.

The following Table gives the denominator you need to use for dividing the amount calculated by multiplying the expected lifespan with annual expenses for various ages and return-over-inflation combinations.

For the second category of investors, who can earn a return of 1% over inflation, the amount required will be lower, as their portfolio balance will grow at a slightly faster rate than the inflation. The retirement amount required will be equal 3.33 crore for meeting inflation-adjusted expenses of 10 lacs per annum. This is calculated by dividing 4 crores (calculated for the first investor) by 1.20 .

For the 3rd category, that earns 2% over inflation - the amount will be 4 Cr divided by 1.40 , equal to 2.85 Cr and for the 4th category (return of 3% over inflation) it would be 4 Crores divided by 1.60 = 2.5 Cr

We are dividing the 4 crore by 1.20 when the rate is 1 % over inflation , which can be seen as 1+ 20 x 1% = 1 + 20 x 0.01 = 1.20

Thus when you have 40 years to go, one can divide 4 core by 1+ 20 x % return over inflation to work out the reduced amount required for retirement.

The rule works for 30 years lifespan and 20-year lifespan too, provided you replace 20 in the above formula by 15 and 10 respectively. This is the 10-15-20 Rule.

The following Table gives the denominator you need to use for dividing the amount calculated by multiplying the expected lifespan with annual expenses for various ages and return-over-inflation combinations.

The 10-15-20 Thumb Rule can be expressed using the following formula:

What if you are not close to retirement age?

You can work out expected annual expense by having some idea of such an amount today and doubling it every 14 years (assuming inflation is 5%). For instance, if you are 46 years of age today and you think you would need 8 lacs if you were to retire today then this 8 lacs will become approximately 16 lacs due to inflation by the time you retire. You should use 16 lacs in the previous calculation instead of 10 lacs as annual expenses.

If you are 28 years from retirement then the 8 lacs today will become 16 lacs in the first 14 years and that 16 lacs will become 32 lacs in the next 14 years. Thus 32 lacs would become your annual retirement expense at the age of 60.

All thoughts and suggestions are welcome.

You can work out expected annual expense by having some idea of such an amount today and doubling it every 14 years (assuming inflation is 5%). For instance, if you are 46 years of age today and you think you would need 8 lacs if you were to retire today then this 8 lacs will become approximately 16 lacs due to inflation by the time you retire. You should use 16 lacs in the previous calculation instead of 10 lacs as annual expenses.

If you are 28 years from retirement then the 8 lacs today will become 16 lacs in the first 14 years and that 16 lacs will become 32 lacs in the next 14 years. Thus 32 lacs would become your annual retirement expense at the age of 60.

All thoughts and suggestions are welcome.

If you have regular rental income, pension etc then that can be taken out of the annual expense, reducing your net annual expenses that need to be met out of the portfolio income. Assuming these income streams are inflation adjusted, you can continue to use the thumb rule.

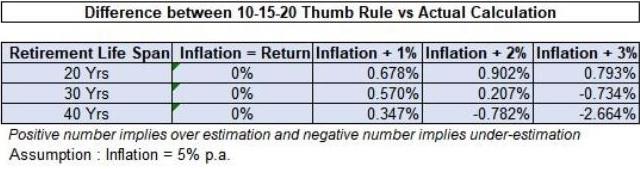

Please do keep in mind that this is an approximate formula and actual number will be slightly different. You can see the table below that compares thumb rule-based number to actual numbers assuming 5% inflation rate. The rule works well for 20-40 years of retirement lifespan and inflation range of 3%-7% range.

Please do keep in mind that this is an approximate formula and actual number will be slightly different. You can see the table below that compares thumb rule-based number to actual numbers assuming 5% inflation rate. The rule works well for 20-40 years of retirement lifespan and inflation range of 3%-7% range.