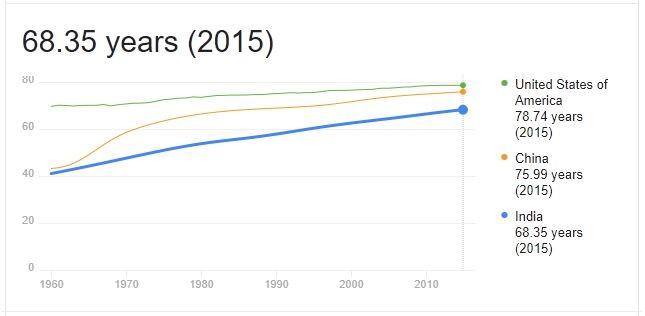

Average lifespan has been increasing in India by approximately 5 years per decade and it stands at 68.35 in 2015 (China is at 76 years and US is at 79 years). This is an average number and it is not uncommon to see people living beyond 90.

Besides better economic prospects and increased health awareness, HealthTech is at a point of inflection. Research in genetics, longevity, nanotechnology, artificial intelligence and increasing computer power could take average lifespan well above 100 in 15-20 years time. Many researchers believe that aging is a disease and it is possible not only to prolong healthy lifespan but also reverse the aging process (I will write a detailed article on this soon).

Most of us usually go through 2 phases in our financial life.

Savings & Growth Phase: where we earn, save and invest money in various avenues like EPF, PPF, NPS, MF, Real Estate etc. We also try meeting most of our financial goals during this phase that may include cars, home, children’s education, vacations etc. We also build our retirement kitty during this phase.

Retirement Phase: Here we focus on generating passive income from the assets that we accumulated in phase one. The idea is to grow these assets so that returns on these assets along with the capital can fund our expenses for the rest of your life.

In the last article, we talked about 10-15-20 thumb (here is the link) rule that can help you quickly calculate the amount that can last throughout the expected lifespan post-retirement. We made an assumption about our expected lifespan for doing that calculation. What if we are wrong and live much longer than expected? Would we run out of money? This question makes many retirees live frugally.

Is it possible to calculate an amount of money that one can have in a retirement kitty so that it lasts for a very long time, say forever? The answer is yes and surprisingly you don't have to be a billionaire to achieve it.

Many insurance companies offer annuity that can pay you constant amount till you live and may appear to meet our needs of lifetime earning. However, in annuities, you lose control over your capital. Besides, most variants of annuity do not adjust payments in line with inflation and hence may not work.

In order to figure out a solution, let’s understand what happens to your kitty post-retirement. You would invest the money in some combination of instruments like Bank FDs, Government Bonds, Debt & Equity Mutual Fund etc. This portfolio would generate a return and will keep swelling with time (there may be some hiccups if you have a large investment in volatile assets like equity, equity MF, commodity etc). A positive return will increase the value and the inflation will erode its purchasing power. Our return must be higher than inflation to increase the real value of the portfolio.

Besides inflation eroding the portfolio value, we will draw down money from this portfolio to meet our regular cost of living. This cost of living also goes up due to inflation, year after year.

In order to make your retirement kitty last forever, we need to ensure that the portfolio value increases at a rate such that it can counter the fall in value due to inflation as well as drawdown from the portfolio for meeting the inflation-adjusted cost of living.

It seems like a complex problem to solve. However, once solved - the answer appears very simple and intuitive.

Let’s say you have 4 Crore of retirement kitty and you are able to generate a post-tax return that is equal to inflation. This implies that the kitty will keep its purchasing power of 4 crores (40 million) for years as long as the post-tax return is equal to the rate of inflation and we do not drawdown any fund from this portfolio.

Well, that does not work as we will have to meet our cost of living thru drawdowns. This means that our post-tax return must be higher than inflation for us to draw down the funds to meet our annual expenses and continue to maintain the purchasing power of the remaining portfolio.

What if we are able to generate a post-tax return that is 1% higher than the inflation? We can utilize this excess return of 1% to meet our annual expenses. This implies that your kitty must be equal to 100 times your annual expenses.

What if we can generate 2% over inflation? Well, then we will need about 50 times our annual expenses in our kitty. The amount becomes around 33 times, in case of return of 3% over inflation and 25 times for 4%.

The actual amount would be slightly different depending upon the rate of inflation. For instance, at 5% inflation the amount required will be 106 times annual expenses at 1% margin, 53 for margin of 2%, 36 times for margin of 3% and 27 form 4% margin.

The actual formula for calculating the required kitty is extremely simple.

Multiple Required = (1+ margin + inflation) / margin

Margin and inflation must be in fractions. For instance inflation of 5% would be expressed as 0.05 and margin of 1% over inflation would be expressed as 0.01

We can put these numbers in the above formula to get the amount = (1+0.05+0.01) / 0.01 = 1.06/0.01 = 106. i.e. one needs to have 106 times the annual expense. That is, one can drawdown 1/106 amount (about 1% of the kitty) annually so that your money lives forever.

If the margin was 2%, then it works out to 53.5 times. i.e. you need 53.5 times your annual expense and every year you can drawdown 1/53.5, i.e. about 2% of the kitty forever.

The multiple for 3% margin would be 1.08/0.03 = 36 times and for 4% it would be 1.09/0.04 = 27.25 times the annual expense.

Thus if your annual expenses are 10 lacs then you would need 10.6 crores, provided that you can generate a return of 1% over inflation. The same amount falls to 5.4 Crore for a return of 2% over inflation, to 3.6 Crore for a return of 3% over inflation and 2.72 crores for a return of 4% over inflation.

Comparison with 10-15-20 Rule:

We had seen that if one could earn 3% post-tax return over inflation then you needed 25 times the annual expenses to ensure that amount lasts for 40 years of retirement life (2.5 Cr for 10 lacs annual expense).

To make the amount last forever you need 3.6 crores if your return is 3% over inflation with inflation at 5% p.a.

Thus as kitty increases from 2.5 crores to 3.6 crores, you could stretch the retirement kitty from 40 years towards infinity, for an inflation-adjusted annual expense of 10 lacs and at a post-tax return of 3% over inflation.

The beauty of this approach is that you would leave the entire corpus of 4 crores (in today's value) for your dependents. You truly survive on your returns.

Besides better economic prospects and increased health awareness, HealthTech is at a point of inflection. Research in genetics, longevity, nanotechnology, artificial intelligence and increasing computer power could take average lifespan well above 100 in 15-20 years time. Many researchers believe that aging is a disease and it is possible not only to prolong healthy lifespan but also reverse the aging process (I will write a detailed article on this soon).

Most of us usually go through 2 phases in our financial life.

Savings & Growth Phase: where we earn, save and invest money in various avenues like EPF, PPF, NPS, MF, Real Estate etc. We also try meeting most of our financial goals during this phase that may include cars, home, children’s education, vacations etc. We also build our retirement kitty during this phase.

Retirement Phase: Here we focus on generating passive income from the assets that we accumulated in phase one. The idea is to grow these assets so that returns on these assets along with the capital can fund our expenses for the rest of your life.

In the last article, we talked about 10-15-20 thumb (here is the link) rule that can help you quickly calculate the amount that can last throughout the expected lifespan post-retirement. We made an assumption about our expected lifespan for doing that calculation. What if we are wrong and live much longer than expected? Would we run out of money? This question makes many retirees live frugally.

Is it possible to calculate an amount of money that one can have in a retirement kitty so that it lasts for a very long time, say forever? The answer is yes and surprisingly you don't have to be a billionaire to achieve it.

Many insurance companies offer annuity that can pay you constant amount till you live and may appear to meet our needs of lifetime earning. However, in annuities, you lose control over your capital. Besides, most variants of annuity do not adjust payments in line with inflation and hence may not work.

In order to figure out a solution, let’s understand what happens to your kitty post-retirement. You would invest the money in some combination of instruments like Bank FDs, Government Bonds, Debt & Equity Mutual Fund etc. This portfolio would generate a return and will keep swelling with time (there may be some hiccups if you have a large investment in volatile assets like equity, equity MF, commodity etc). A positive return will increase the value and the inflation will erode its purchasing power. Our return must be higher than inflation to increase the real value of the portfolio.

Besides inflation eroding the portfolio value, we will draw down money from this portfolio to meet our regular cost of living. This cost of living also goes up due to inflation, year after year.

In order to make your retirement kitty last forever, we need to ensure that the portfolio value increases at a rate such that it can counter the fall in value due to inflation as well as drawdown from the portfolio for meeting the inflation-adjusted cost of living.

It seems like a complex problem to solve. However, once solved - the answer appears very simple and intuitive.

Let’s say you have 4 Crore of retirement kitty and you are able to generate a post-tax return that is equal to inflation. This implies that the kitty will keep its purchasing power of 4 crores (40 million) for years as long as the post-tax return is equal to the rate of inflation and we do not drawdown any fund from this portfolio.

Well, that does not work as we will have to meet our cost of living thru drawdowns. This means that our post-tax return must be higher than inflation for us to draw down the funds to meet our annual expenses and continue to maintain the purchasing power of the remaining portfolio.

What if we are able to generate a post-tax return that is 1% higher than the inflation? We can utilize this excess return of 1% to meet our annual expenses. This implies that your kitty must be equal to 100 times your annual expenses.

What if we can generate 2% over inflation? Well, then we will need about 50 times our annual expenses in our kitty. The amount becomes around 33 times, in case of return of 3% over inflation and 25 times for 4%.

The actual amount would be slightly different depending upon the rate of inflation. For instance, at 5% inflation the amount required will be 106 times annual expenses at 1% margin, 53 for margin of 2%, 36 times for margin of 3% and 27 form 4% margin.

The actual formula for calculating the required kitty is extremely simple.

Multiple Required = (1+ margin + inflation) / margin

Margin and inflation must be in fractions. For instance inflation of 5% would be expressed as 0.05 and margin of 1% over inflation would be expressed as 0.01

We can put these numbers in the above formula to get the amount = (1+0.05+0.01) / 0.01 = 1.06/0.01 = 106. i.e. one needs to have 106 times the annual expense. That is, one can drawdown 1/106 amount (about 1% of the kitty) annually so that your money lives forever.

If the margin was 2%, then it works out to 53.5 times. i.e. you need 53.5 times your annual expense and every year you can drawdown 1/53.5, i.e. about 2% of the kitty forever.

The multiple for 3% margin would be 1.08/0.03 = 36 times and for 4% it would be 1.09/0.04 = 27.25 times the annual expense.

Thus if your annual expenses are 10 lacs then you would need 10.6 crores, provided that you can generate a return of 1% over inflation. The same amount falls to 5.4 Crore for a return of 2% over inflation, to 3.6 Crore for a return of 3% over inflation and 2.72 crores for a return of 4% over inflation.

Comparison with 10-15-20 Rule:

We had seen that if one could earn 3% post-tax return over inflation then you needed 25 times the annual expenses to ensure that amount lasts for 40 years of retirement life (2.5 Cr for 10 lacs annual expense).

To make the amount last forever you need 3.6 crores if your return is 3% over inflation with inflation at 5% p.a.

Thus as kitty increases from 2.5 crores to 3.6 crores, you could stretch the retirement kitty from 40 years towards infinity, for an inflation-adjusted annual expense of 10 lacs and at a post-tax return of 3% over inflation.

The beauty of this approach is that you would leave the entire corpus of 4 crores (in today's value) for your dependents. You truly survive on your returns.

Life is unpredictable and its very hard to estimate how long we would live. Most calculations in financial planning require our life expectancy as an input. What if you are wrong and surpass your estimate?

Estimating one's life expectancy is very tricky. We don’t know how long we will live. The average lifespan has been increasing both in developed and developing countries.

Estimating one's life expectancy is very tricky. We don’t know how long we will live. The average lifespan has been increasing both in developed and developing countries.

How to make your money last long, really long?